The Present Money System –

Functioning, Dysfunctions and Future Perspectives

Introduction

This paper provides an up to date outline of the workings of the money and banking system - how money is created, how it circulates in the payment system, how it is temporarily de- and re-activated, and how it is finally deleted. This then helps clarify why a number of orthodox money and banking theories are obsolete, in particular the financial intermediation theory of banking in connection with the loanable funds model of deposits, the models of a credit multiplier, the reserve position doctrine, and other rather fictitious elements of present-day monetary policy.

However, some more advanced approaches also contribute to disorientation, for example, when describing the present system as a chartalist or sovereign currency system, or when defending the false identity of money and credit, or postulating an arbitrary notion of endogenous and exogenous money, or when denying the constraints on bankmoney creation.

The picture is rounded off by a summary of the dysfunctions of split-circuit reserve banking and a brief outlook on the perspective of a single-circuit sovereign money system.

Main elements of reserve banking today

The split-circuit structure of reserve banking

One of the first things to be read in most textbooks about money and banking is the two-tier structure of the system. One tier is the central bank of a currency area; the other is the banking sector. This is patently obvious were it not for some misleading views most often coming with two-tier explanations, for example, that in the first instance the money is created by the central bank, loaned to the banks, and loaned out from the latter to bank customers, or used as the basis for creating bankmoney as a multiple of the central bank money. As expounded below, nothing of this does apply as imagined.

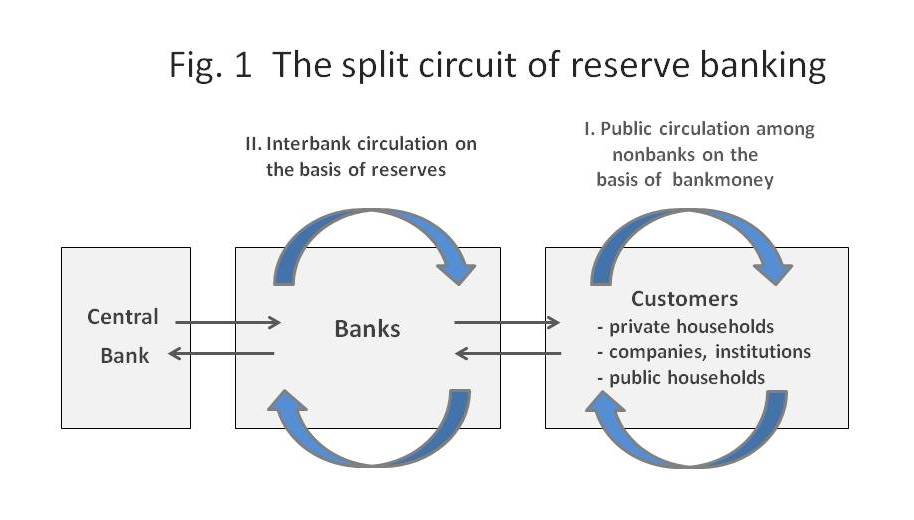

What is more, the two-tier description of banking does not make explicit a most fundamental feature of the system, which is the split-circuit structure of modern reserve banking. The system consists of two different money circuits. One is the public circulation of bankmoney among nonbanks. Bankmoney is another term for demand deposits or sight deposits in a current account, also called a giro account, used in cashless payments. The term nonbank refers to the bankmoney-using public, including non-monetary financial institutions such as funds or trusts, non-financial firms, private households, and public households as far as the latter run bank accounts. Nonbanks run their accounts with banks. Except for some government bodies, nonbanks are not admitted to central bank accounts.

The other circuit is the interbank circulation of reserves among banks. Reserve is the technical term for non-cash central bank money on a bank's operational account with the central bank (see Figure 1). More precisely, the reserves referred to here are payment reserves, i.e. liquid excess reserves for making interbank payments, in contrast to basically illiquid minimum reserve requirements.

The two circuits are separate and never mingle; however, the public circuit is technically tied to the interbank circuit, whereas the interbank circuit is basically independent, even though it helps mediate the cashless payments among nonbanks.

Reserves and bankmoney represent two distinct classes of money that cannot be exchanged for one another. Customers never obtain reserves in their current accounts, and bankmoney cannot be transferred into a bank's central bank account. Customer deposits (bankmoney) thus cannot be used by banks to make interbank payments, and cannot be lent by banks to whomsoever; only customers themselves can spend, or invest, or lend their deposits (bankmoney) to other nonbanks.

Modern money is non-cash

As far as banknotes and coins are still in use, cash circulation represents a third circuit. Cash is central bank money, too, but in a basically cashless money system cash is no longer of defining relevance. Within the frame of reserve banking, cash and money-on-account must not be confused as is done by negligent speak, and even by official accounting standards.[1] At source, modern money is non-cash, a credit entry into a respective account. In the split-circuit structure, this applies to both bankmoney and central bank money. Traditional solid cash (coins, notes) has become a residual technical subset of the bankmoney in circulation, withdrawn from or exchanged back into a bank giro account.

Since about the 1920–60s, when bankmoney was definitely driving out solid cash in the course of the general diffusion of cashless payment practices, cash has no longer been constitutive of the money system. Cash now represents about 3–20% of the stock of money, depending on the country and delimitation criteria, and a continued declining share in the long run. Cash can thus now largely be excluded from monetary system analysis (in spite of its present role as an effective hindrance to misguided negative interest rate policies of central banks).

Credit extension and money creation in one act

Bankmoney and reserves are also called credit money or debt money because that money is created in one and the same act with crediting an account. Bankmoney is created when a bank enters previously non-existent currency units into a customer account. This creates a demand deposit. What makes the difference between a bank and a non-bank financial institution is a bank's ability to create primary credit that creates bankmoney, in contrast to secondary credit which is about lending or investing of already existing bankmoney among nonbanks.

Central bank money (reserves) is created in the same way through the central bank crediting a bank's account with the central bank. Central bank credit as well as bank credit is primary or originating, they are not about transferring already existing amounts of reserves or bankmoney.

'Credit creates deposits' has become a standing formulation in post-Keynesianism and its offspring such as circuitism, monetary quantum theory and so-called modern money theory. The opposite of 'deposits create credit' no longer applies to the bank-customer relationship in a predominantly cashless money system. This was already recognized in the bank credit theory of money from the 1890–1920s, but largely ignored by the neoclassical mainstream, except for the Austrian School, the early Chicago School and German ordoliberalism.[2] Keynes' writings are somewhat contradictory in this regard. He endorsed the bankmoney theory in his earlier writings, but fell back on the formula of 'investment = savings' in his later General Theory. Under conditions of primary bankmoney creation the formula still applies to secondary credit among nonbanks, no longer, however, to primary bank credit.

Banks create credit and bankmoney whenever they make payments to nonbanks, for example when granting loans and overdrafts, or purchasing assets such as bonds, stocks, other securities or real estate, and also when paying salaries and bonuses to employees or nonbank service providers. However, the latter payments to employees or service providers are charged to the loss statement of a bank and thus its equity, whereas credit claims or securities are booked as assets.

Early private banknotes in Europe from the 1660s to the 19th century were promissory notes. The issuing bank promised the bearer to convert the note into silver coin anytime on demand. The banknote was a surrogate for the 'real thing' which was precious metal coin or gold bullion, until banknotes were made legal tender and the monopoly of a national central bank, thus the 'real thing' by itself that consequently did not need gold coverage anymore and was finally taken off the gold standard.

In an analogous way, present-day bankmoney is a promissory ledger entry, in that the bank promises the customer either to cash out the bankmoney or to transfer the currency units to other bank accounts anytime on demand. Bankmoney is thus a claim of the customer on the bank, or the other way round, a liability of the bank to the customer. Bankmoney is a surrogate for solid cash (coins and notes) and reserves (central bank money-on-account).

It has now unfortunately become a drag on the further advancement of monetary theory that in various strands of post-Keynesianism today's credit and money creation in one act has been over-generalised into a doctrine of the alleged identity of money and credit, an identity that is seen as natural and functionally necessary.[3] This, in turn, has contributed to the strange phenomenon that many post-Keynesians are critical of financial capitalism, while at the same time standing up as fierce Banking School defenders of the present bankmoney regime, not recognising how that regime lies at the root of what they criticise.[4]

The fact that credit creation and money creation are done in one act today must not prevent us from recognising that money and credit are two different functions, albeit blended today. However, once bankmoney has been created, it circulates as an incoming and outgoing monetary asset only. Strictly speaking, credit creation creates but IOUs¾which however we have adopted as the preferred means of payment. Credit does not create 'money proper' as Keynes called it, such as former precious metal money which, at source, did not involve credit and debt. That money was simply a monetary asset. It entered into circulation in that it was physically produced and then spent, not loaned. Rather than being an IOU in itself, it just facilitated payments, that is, the final settlement of an IOU in financial and real transactions.

Moreover, one should be aware of the dual use of the word credit. It means (a) making a loan or financial investment, but then again it simply means (b) the accounting procedure of crediting/debiting some account, also figuratively speaking, for example, when students obtain credits for their exam achievements. The horizontal arrows in Figure 1 signify (a) credit creation adding to the stock of money. The thicker circular arrows signify (b) credit transfer, i.e. money circulation, not adding to the stock of money. Most crediting and debiting of accounts involves the circulation of already existing money, for example as earned income, sales proceeds, transfer payments, donations, etc. It is relatively rare that crediting an account coincides with extending bank credit (a bank granting a loan).

The money system is bank-led

Another term for reserves in the two-tier context is high-powered money. This is right and misleading at the same time. It is right because, in comparison with bankmoney, reserves are the money class of higher order and, if representing a strong currency, also the safer asset. However, this can be misleading if it obscures the fact that bankmoney is the dominant and decisive class of money today.

Within the present frame of split-circuit reserve banking, credit extension and money creation is bank-led. The initiative of money creation is with the banks, not with the central banks as is most often assumed. It must be taken literally that central banks re-finance the banks, re-actively, upon or after the facts the banks have created beforehand. Central banks do not pre-finance the system by setting reserve positions first. The causation runs in the opposite direction. Central banks accommodate the banks' defining demand for central bank money (reserves and cash). This element was introduced into monetary economics by the accommodationist strand of post-Keynesianism.[5]

Through their pro-active lead in primary credit creation (bankmoney creation), banks determine the entire money supply, including the accommodating creation of reserves and cash by the central banks. Bankmoney is not the result of some sort of multiplication of central bank money. Quite to the contrary, the stock of central bank money is a follow-up quantity, a kind of sub-set of the stock of bankmoney.

Is bankmoney 'endogenous', and are central banks 'outside' the markets?

In post-Keynesianism bankmoney is considered endogenous, that is, created from within the economy according to demand, in contrast to exogenous money that is injected into the economy from the outside.[6] An analogous terminology thus distinguishes between inside and outside money.[7]

Although endogeneity of modern money can basically be endorsed, the distinction represents arbitrary labelling and contributes to mystification rather than clarification. If 'exogenous' money has existed ever at all, it was the traditional metal money the supply of which depended on natural deposits of silver, gold and copper. Modern money, by contrast, consists of purely informational units, symbolic tokens, that are always created in response to economic needs and interests.

Furthermore, it is not just anybody 'inside' the economy who can create their own money to use as a regular general means of payment. Only banks and central banks are relevant money creators, and to what extent the money they supply is endogenous or exogenous is actually open to debate.

If endogeneity is understood as money creation upon market demand, automatically bringing about an optimal money supply, this reflects misleading Banking School doctrine. Modern fiat money can be created at discretion, and market demand for money thus can be, and often is, excessive in self-reinforcing feedback dynamics of business cycles and financial cycles.

Banks and central banks create credit and deposits in the same way. Both do it basically on market demand. The banking industry, however, does not just supply what is demanded. The banks supply bankmoney very selectively according to their own preferences. Ever more frequently they initiate business opportunities themselves, especially in investment banking. By contrast, the central banks today deliver the reserves as demanded by the banking sector (or, as needed in a banking and debt crisis to avoid pending insolvency). Since the failure of monetarist policies in the 1970s, central banks do no longer intend to exert control over the stock of money, including their own credit and reserve creation. Instead, central banks now undertake quantity-disconnected interest rate policies, supposed to influence the real-economic inflation rate by way of some nebulous transmission mechanism.

Consequently, if bankmoney is seen as endogenous in the economy, and banks as 'inside the markets', the same must be said of central bank money. If central bank money is seen as exogenous to the economy and exerting control from the 'outside', then this also applies to bankmoney.

Credit creation and balance sheet extension by cooperative bankmoney creation

The most widespread representation of bankmoney creation is by balance sheet extension of a single bank. According to this view, the respective bank makes a pairwise asset and liability entry on its balance sheet: on the asset side a credit claim on the customer securing their interest and redemption payments, and on the liability side an overnight liability to the same customer, obliging the bank to cash out or transfer the credits on demand of the customer.

This representation corresponds to an internationally widespread accounting practice (the first step of granting a credit, different from the following steps of making use of the credit). Thus far, however, the representation does not really make sense. A customer does not take up money to keep it on account, but to make payments due¾and as soon as the customer withdraws the bankmoney in cash or transfers the bankmoney to somewhere else, the balance sheet extension of the respective bank is reversed, in that the liability to the customer is closed out, and the cash account or reserves account of the bank is debited.

This reflects the fact that balance sheet extension by bankmoney creation is not an individual act by a single bank, but a cooperative process by many banks in the entire banking sector, in that a credit claim or other asset is added to the balance sheet of a credit-creating bank, while the related overnight liabilities (bankmoney) appear on the balance sheet of the recipient banks. All banks have to accept each other's liabilities transferred to them. Bankmoney creation could not otherwise work.

A balance sheet extension, both collectively and, in consequence, also individually, results from continued credit creation and mutual acceptance of bankmoney. The additional credit claims add to the balance sheet of banks as credit issuers to nonbanks, while the bankmoney liabilities add to the balance sheet of the banks as recipients of payments from the customers of other banks.

Bankmoney transfer via reserve transfer

Figure 2 below may help illustrate the transfer of money among banks and nonbanks. The figure again shows the separate circuits of interbank circulation (in darker shade above) and public circulation (in lighter shade below).

If, say, customer A at bank X wants to transfer bankmoney to customer Q at bank Y, this cannot be carried out directly by inter-customer transfer from A's account to Q's account. Instead, the transfer is carried out indirectly and involves the following steps:

- Bank X debits the current account of customer A, and

- transfers the respective amount in reserves to bank Y.

- Bank Y receives the reserves, and

- credits the amount of bankmoney into the account of customer Q.

The role of banks here is often depicted as that of a trusted third party that carries out and documents payments among nonbanks. It can be seen this way, but can also be misunderstood as if a bank would transfer bankmoney, like cash, from A to Q. Such a transfer, however, takes place only as the transfer of reserves in the interbank circulation, where the central bank is the trusted third party that debits and credits the bank accounts on its balance sheet.

With regard to public circulation the process is somewhat different: Debiting the customer account at bank X actually means deleting the respective amount of bankmoney; while crediting the customer account at bank Y means re-crediting that amount. The banks are here in the role of active creators and extinguishers of bankmoney rather than just re-booking money on a single balance sheet. The process of bankmoney transfer may nevertheless be called a payment service or 'intermediation' – on the understanding, though, that this refers to monetary, not financial intermediation, the latter being about the idea a bank would use its customers' bankmoney for making loans or purchases. In the split-circuit structure, however, a bank cannot use the customers' bankmoney for its own purposes, and a bank does not need to do so, because a bank always creates credit by itself when it makes payments to customers, as it deletes credit when it receives payments from customers.

In lieu of immediate payment in reserves, or shipping of cash historically, there has always been the practice of clearing of payments due to and from a bank, on an ongoing basis until further notice or some ceiling, or on a day-by-day basis, with final settlement of the resulting bottom line in reserves at the end of the day.

Today, most central banks and/or the banking industry run real-time gross-settlement (RTGS) payment systems. In the purest form, a payment order in such a system prompts an immediate debit from the reserve account of the remitting bank and a credit entry in the recipient reserve account. Other computerised payment systems involve immediate clearing of payments to and fro, so that the bottom line of each bank's payments is clear at any point in time, while the final settlement in reserves is carried out once a day.[8]

The situation is different again with payments among customers of a same bank. That bank is vis-à-vis its customers in the role of the trusted third party (rebooking deposits) as is the central bank vis-à-vis the banks (rebooking reserves). If, for example, in the figure above customer A of bank X wants to transfer bankmoney to customer B of the same bank, bank X simply debits the current account of customer A and credits the current account of customer B. Thus far, the bank neither needs cash nor reserves.

Were a bank to be huge and cover, say, half of all customers within a currency area, then about half of all cashless payments would be carried out by simple internal rebooking of overnight liabilities among the internal customers, without that bank needing central bank money and the central bank's cooperation. This, in fact, occurs to a degree in all banks, in large ones anyway, but even in small ones, and also in banks that participate in a banking union, pooling the participants' reserves. The latter practice is widespread among cooperative and municipal banks. Still, however, and despite the formation of banking oligopolies in many countries, the vast majority of domestic and international cashless payments include interbank transfers among different banks; and when transferring a customer deposit into an external account with another bank, the sending bank will need to have or obtain reserves which are transferred to the recipient bank. It applies nonetheless that the larger the bank, the more independent it is of central bank reserves. This would be all the more pronounced by abolishing cash, thus cash reserves in vault.

Deletion of bankmoney and reserves

Deletion or extinction of credit money is simply the reverse process of its creation. As any payment from a bank to a nonbank creates bankmoney, any payment from a nonbank to a bank deletes bankmoney.

Consider the example of a bank's external nonbank borrower who pays interest and repays principal. In this case, the bankmoney is deleted, in that it is debited from the payer's account at the remitting bank, thus closed out, and not re-credited at the recipient bank. Instead, the recipient bank obtains the amount of interest and principal due from the payer's bank in reserves. The interest payment adds to the earnings account of the recipient bank, which in the end contributes to the bank's equity account. The repaid principal results in closing out, thus deleting, the respective credit claim on the customer. Closing out the liabilities there and the claims here represents a co-operative balance sheet reduction.

If the process is about an internal customer of a bank, this does not involve interbank transfer of reserves. Simply, the interest payment debits the customer account, deleting the bankmoney, and credits the bank's earnings account. The repayment of principal is reflected in the pairwise deletion of the bankmoney (liability) and the credit claim (asset), again representing a balance sheet reduction.

In the same way, any payment from the central bank to a bank creates reserves, as any repayment from a bank to the central bank deletes reserves.

De- and re-activation of bankmoney

As may have been noticed, savings and time deposits are not involved in the processes discussed so far. What is that money used for? It isn't used at all: it is deactivated bankmoney, temporarily immobilised, so to speak, for a fixed period of time (maturity) or at notice. Deposit savings are not used, and actually cannot be used either by the banks or by the customers themselves as long as they are not re-activated by transferring them back to a current account.

Why then do customers run savings and time accounts? For customers, deposit savings represent a store of wealth, even if modest in most cases, a sort of near-term capital, also referred to as 'near-money', easy to reactivate if need be. Savings and time deposits can also serve as collateral. In normal times, savings yield the customers deposit interest, even if comparatively low.

But why do banks accept rather than deter interest-bearing deposit savings they cannot make use of? At first glance this seems to be an obsolete remnant from former times when the economy was largely cash-based and the banks needed their customers' cash deposits to fund the asset side of their business. Today, however, the banks need cash only for feeding the ATMs, which is no longer of relevance to a bank's lending and investment business.

The function of deposits has seamlessly changed. Today, deposits help maintain customer loyalty. Paying some deposit interest prevents the deposits from draining off to the competition. If this were to happen to a critical extent, the affected bank would face a severe liquidity problem, because more reserves would be going out without this being offset by incoming reserves. Borrowing the missing reserves on the interbank market would be costly, impairing a bank's business position. Offering savings and time accounts shields the banks from such a liquidity risk, while allowing them to carry on with creating additional bankmoney at lending rates that are much higher than the deposit rates.

From a macroeconomic point of view, deactivated bankmoney, like all inactive money, does not contribute to effective demand, either to the money or capital supply on secondary credit markets. It thus has no effect on inflation and asset inflation. Even if deactivated bankmoney can hypothetically be reactivated within a short period of time, this does not happen in practice. Conversions of savings and time deposits into overnight deposits (liquid bankmoney) are normally more than compensated for by other customers converting overnight deposits into savings and time deposits. In times of crisis, too, most customers try to maintain rather than dissolve their deposit savings.

Fractional reserve banking and its operating conditions

The astounding thing about reserve banking now is that the quantity of reserves in interbank circulation is only a fraction of the amount of bankmoney in public circulation. In order to create an amount of deposits (bankmoney) and maintain it in circulation, the banking sector needs central bank money of an amount that is only a small fraction of the credited bankmoney.

In the US, for example, that fraction is about 8.5% or less of the stock of liquid bankmoney, comprising 1% cash for the ATMs, 0.1–0.5% liquid reserves (excess reserves) for the settlement of payments, and 10% obligatory minimum reserve minus the cash and further items. In the euro area, the fractional base of central bank money amounts to only about 2.5% of the stock of liquid bankmoney (M1), comprising 1.4% cash, 0.1–0.5% payment reserves, and 1% minimum reserve requirement.[9] Minimum reserve requirements have been abolished in the countries of the British Commonwealth, Scandinavia (except euro-member Finland) and Mexico so that the remaining fractional base of excess reserves is tiny.[10]

How can it be that banks make do with such a very small base of central bank money, especially in view of pure RTGS systems where payments are not cleared before settlement, but settled real-time in full? There is no magic, just a number of operating conditions as follows.

Outflows equal inflows

Outgoing reserve payments of a bank are incoming reserves in other banks, so that the payments from and to the banks in the system are more or less offsetting each other. The reserves received can immediately be re-used in ongoing payments. In practice, the resulting payment balances represent some surplus or deficit, for example in international payments, and more likely to occur in smaller banks rather than large banking corporations where outgoing and incoming payments can offset one another even within minutes and seconds. Payment balances thus remain rather small and can easily be dealt with on the interbank money market as well as by the intraday-overdraft as it is provided in today's RTGS payment systems.

Cooperative bankmoney creation

This principle has already been touched upon. It means that the pace and rate of credit extension and bankmoney creation must take place roughly in step throughout the banking sector, so that the credit claims and liabilities of the banks largely grow in step with each other, and outgoing and incoming reserve payments do not result in significant imbalances. This, in turn, requires the banks to accept each other's transfers of deposits (bankmoney). In today's computerised payment systems this can be taken for granted, in contrast to former cash-based economies when banks were often reluctant to accept the private banknotes of other banks.

Distributed transactions

Payments are spread over time and actors and do not include all of the actors' bankmoney at once. This means that only some part of the bankmoney is used at any point in time, with outgoing and incoming reserve payments largely offsetting one another.

Non-segregation of customer money

All outgoing and incoming payments of a bank are processed via one and the same operational central bank account of a bank, no matter whether the payments relate to customers or a bank's own dealings. Within the split-circuit system, the reserves related to a bank's own transfers and the reserves related to carrying out bankmoney transfers among customers cannot properly be distinguished, and given the fractionality of reserves, attempting to separate the reserves related to customer payments would not make much sense. Non-segregability of customer money is an additional advantage for the banks, amplifying the aforementioned conditions.

The combined effect of these conditions or mechanisms results in the frequency of reserve circulation in the interbank circuit being many times higher than is the case with bankmoney in public circulation. Put the other way round, the velocity of bankmoney circulation in the public circuit is many times slower than the high use frequency of reserves in the interbank circuit. This is the entire 'trick' that enables the fractionality of reserve banking.

A bankmoney regime backed by the central banks and warranted by governments

Almost all schools of thought from both the neoclassical and Keynesian hemispheres of economics still depict the present money system as basically a sovereign currency system, with a mixed supply of sovereign money (central bank money) and bankmoney.

Many bankers and academics even deny bankmoney creation, believing in deposits as a means of bank funding, and thinking that banks have to settle all expenses in full, not fully understanding the split-circuit nature of the reserve system and the different velocities of reserve and bankmoney circulation.

Moreover, as public circulation of bankmoney is tied to interbank circulation, and bankmoney thus still depends on a base, however small, of reserves and cash, this prompts most experts to misperceive the overriding importance of bankmoney, misunderstanding its status as a money surrogate as 'subordinate' to cash and reserves. Solid cash, however, has become systemically irrelevant, and the reserves have become accommodatingly subservient to pro-active bankmoney creation. It is true that of the two classes of money, central bank money represents the safe and more reliable asset; and yet this is misleading, in that it conceals the fact that bankmoney is by far the dominant means of payment today, and that the pro-active primary credit creation by the banks determines the entire money supply.

In actual fact, the split-circuit bank-led reserve system is a bankmoney regime, based on fractional reserve banking backed by the central banks, the more so in times of crisis, and warranted by governments as if it were about sovereign money. Far from representing what would deserve to be called a sovereign money system, this is a state-backed rule of private bankmoney. Of the three sovereign monetary prerogatives—the currency, the money and the seigniorage (i.e. the gain from money creation)—the bankmoney regime has captured money creation and seigniorage-like benefits, especially in the form of refinancing costs avoided. Only the national monetary unit of account, the currency, is still defined by the state.

Old paradigms die hard

Against the background of the functioning of the money system discussed so far, it is easy to refute a number of old paradigms that have become obsolete or were misleading from the outset.

The piggy bank model

One of the oldest notions of banking, dating back to cash economies, is the piggy bank model. This includes ideas such as 'deposits are created by depositing cash' or 'my money is in the bank'. Today, the first variant is wrong and the second does not make sense.

Even if using cash is still relatively widespread in some countries, cash is normally just about small transactions and is no longer the fundamental construction element of the monetary system it once was. Depositing cash today always means re-depositing it, in a subordinate follow-up transaction to primary bank credit and withdrawing some part of it in cash.

What, however, is in a bank account? Not 'nothing' as die-hard believers in gold would have it, but not 'the real thing' either, just a claim on it. The 'real thing' is legal tender or central bank money, or sovereign money where the central bank has the legal status of a supreme monetary authority. In the split-circuit reserve system, however, the 'real thing' – reserves on central bank account – remains a bank's possession that is never transferred into a customer account.

The loanable funds model of deposits

The loanable funds model conveys the idea that deposits are a means of bank funding and that 'the banks are working with our money'. This was certainly right throughout the metal age of money. It was an ongoing debate for centuries whether or not a bank's use of customer cash deposits ¾that is, banking on a fractional cash reserve¾was 'irregular' and fraudulent.[11]

However, with regard to savings accounts, their explicit purpose in former cash-based economies had always been to fund the banking business. Interest-bearing savings accounts were offered by Venetian bankers from the Middle Ages, regardless of the Church's ban on interest ('Venetian first, Christian second'). Other Italian banks by and by adopted the practice, and from around 1500 savings accounts spread across Europe, particularly when Pope Leo X officially lifted the canonical ban on interest. Leo, a Medici, was highly indebted, and the Vatican, too, needed funds for the continued construction of St. Peter's Basilica. Fugger, at the time the preeminent banker of princes and cardinals, said the money could only be attracted by a 5% interest on deposit savings¾and by selling papal indulgences, serving the redemption of Fugger's loans rather than of Christian souls.[12]

Today, deposits are no longer loanable funds, because in the split-circuit reserve system a bank cannot and need not make use of its customer deposits.[13] Rather than the banks using our money, we are using bankmoney. Cash remittances still fund cash withdrawals, but only as a residual remnant on a diminishing scale. Among nonbanks, however, on secondary credit markets, bank deposits (bankmoney) are used as loanable funds among nonbanks further on, and on a large scale.

The financial intermediation theory of banking

Since a bank in the split-circuit reserve system cannot pass on reserves to customers, and since a bank creates customer deposits, but cannot use the deposits thereafter for funding further banking business (for which they need a fractional base of reserves and residual cash), banks in the split-circuit reserve system can definitely not act as financial intermediaries. Assuming some such financial intermediation is presumably still the most widespread banking fallacy.

As deposits do not fund bank loans or other bank expenses, bank-financed

lending and investment does not put in savings, but operates on self-created bankmoney. If there is a shortage of money or capital, this is not for monetary reasons. Modern money can be created anytime and, basically, at any amount if non-bank financial institutions, governments, firms and private households are willing to take up debt and the banks backed by the central banks are willing to extend credit. A modern bank is not a savings and loan association as, for example, building societies have formerly been. Present-day banks are monetary institutions, creators of primary credit and deposits, then de- and re-activators, and finally extinguishers of deposits (bankmoney).

In contrast, non-monetary or non-bank financial institutions are financial intermediaries indeed, for example, investment trusts, funds of any kind, the insurance industry, peer-to-peer lenders or crowdfunding platforms. They operate on bankmoney, taking it up from upstream savers and loaning or investing it downstream. Funds doing so may belong to a banking corporation, but this does not turn such funds into banks, as it does not turn the banks themselves into financial intermediaries. Referring to non-monetary financial institutions as shadow banks is most often confusing, except for money market funds whose shares are used since the 1980s especially on financial markets as a new deposit-like money surrogate, in fact a bankmoney surrogate.[14]

As a consequence for macroeconomics, the central identity of 'investment equals savings' is in need of overhaul. It is still applicable to secondary credit markets among nonbanks, supposing that macroeconomics would finally be capable of introducing a distinction between GDP-contributing and non-GDP financial investment.[15] As far as banks are involved, however, 'investment equals savings' does not apply because deposit savings are deactivated and thus irrelevant for bank-financed investment, while the banks can create new additional funds for financial and real investment, as well as for other kinds of expenditure, at their own discretion¾'out of nothing', metaphorically speaking.

The credit multiplier, the reserve position doctrine and other fictitious elements of monetary policy

Although rendered obsolete by the development of split-circuit fractional reserve banking, the multiplier model can still be found in most textbooks in numerous variants. Their common key feature is an amount of money (M) that is credited (Cr) to customers. The money is supposed to flow back to the banks, where it is thought to be re-used to extend credit to customers again, and so on. At each round, the banks retain a certain reserve rate of the money (Res). The amount of extendable credit thus is Cr = M (1-Res), and the total extendable amount of credit is Cr = M/Res.

This is a nice example of the proverbial 'garbage' as it can occur in modelling.[16] The multiplier model does not include a distinction between cash, reserves and bankmoney. The model thus either starts from the misleading idea of a cash economy, or it wrongly considers customer deposits to be loanable funds and the banks to be financial intermediaries. The model does not take into account how the alleged creditary money recycling of the banks connects to the non-credit-creating circulation of the money.

Most importantly, there is neither addition to the money supply, nor deactivation and deletion of money.[17] The model presupposes the amount of money as an exogenously pre-existing and basically invariable quantity, rather than building on an endogenous and variable money supply. The model puts the stock of money first, as this corresponds with the reserve position doctrine of monetary policy transmission, and the banks' credit creation second, rather than the reverse, which is actually what applies in the split-circuit bankmoney-led system of money creation.

The fact that the split-circuit money system is bankmoney-led and re-actively accommodated by the central banks to only a small fraction of the bankmoney invalidates most conventional wisdom on monetary policy and supposed transmission mechanisms.

For one thing, this applies to the reserve position doctrine, that is, monetary policy by setting reserve positions.[18] The doctrine has it that a pre-set quantity of reserves, in combination with the alleged multiplier mechanism, allows exerting control over the banks' credit extension and bankmoney creation. The doctrine may have had a point in the times of cash-determined economies with a central bank monopoly on cash. Over the last century, however, the situation has completely changed. No wonder that conventional quantity policies failed, from the gold standard to monetarism.

The main lever of reserve-position policy is the minimum reserve requirement, as still imposed by most central banks. How is that transmission supposed to work if the banks have the proactive lead and the central banks promptly provide the excess reserves the banks are demanding and the minimum reserves the banks are required to hold? From this angle, minimum reserves are utterly pointless, except for the related interest earnings of a central bank from lending the reserves to the banks.

Believers in reserve policies still think the price of the reserves will do the trick. But the short-term interest rate doctrine must also be doubted, that is, monetary policy by setting central-bank refinancing rates ('base rates' on base money M0), somewhat misleadingly also called 'lead rates'. Causation from central bank rates to the banks' credit and bankmoney creation is not discernible, nor causation from central bank rates to the general inflation rate, only some limited effect on the banks' lending rates.

How should the interest on a 2.5% or 8.5% base of central bank money exert decisive control over the 100% of bankmoney, all of which can be issued at lending rates much higher than the base rate on a small fraction of the bankmoney? This is all the more questionable as bankmoney creation is pro-active and the banks' residual demand for central bank money is price-inelastic once the bankmoney facts have been created, at least in the short run. A possible feedback effect in the longer run appears plausible to a degree, but cannot clearly be discerned either.

The only interest rates a central bank can definitely set are its own rates on the small fraction of reserves. Central banks can also effectively influence interbank rates by expanding or reducing a little the fractional reserve base. The effect of this, however, is low for the same reasons as mentioned above. Thus, the transmission from interbank rates to public rates and bankmoney creation is not evident¾more directly speaking, largely fictitious¾at least in terms of market economics.

What central banks can effectively do in the split-circuit reserve system is create reserves by monetising debt. And this is what they are doing, all the more in times of banking and debt crises, presently by the insolvency-deferring policies of quantitative easing for banks and nonbank financial institutions, near-zero interest rates supporting heavily over-indebted governments, and negative interest rates. The latter, at the beginning, are debiting the banks, but when imposed on the banks' customers, negative interest will burden the customers to the banks' relief.

Such policies are as dysfunctional as is the entire split-circuit reserve system. They not only support shaky banks and over-indebted public households, but also the non GDP-contributing stocks of financial capital, while burdening useful deposits and savings, overall adding still further to what is already too high (debt) or too low (real interest rates), over time even threatening the banks that are meant to be stabilised by such measures.[19]

Where an effect of base rate policy on interest rates and bankmoney creation in the public circuit can be identified, that effect is due to voluntary price administration by the banks. Quite a few banks tie certain lending rates¾for example, for overdrafts or mortgages¾to interbank rates such as the Fed Funds rate (dollar), LIBOR (pound) or EONIA (euro). Ironically, this is an exercise in bureaucratic central planning rather than the market-borne price dynamics of supply and demand.

If there is no effective transmission from central bank to banks anymore, or only weak and insufficient transmission, it follows that central bank monetary policy does not really influence the economy and related inflation rates. However, by monetising vast amounts of financial debt, central banks contribute to asset inflation, particularly in stocks, commercial real estate, private housing, commodities and other financially overstrained real assets, including derivatives on these underlyings. This then comes with a financial bias of income distribution, impairing aggregate demand and real output.

Lost control. Dysfunctions of the bankmoney regime

Quite a few economists consider the bankmoney regime a sophisticated and neutral system. It is assumed to work, and to do so without noteworthy effects on finance and the economy. But assuming the monetary system to be 'neutral' is a rather strange doctrine of neoclassical economics – the more so in view of the effective exercise of power related to the creation, allocation and distribution of money, a power that shapes markets and lives and is in no way inferior to the legal authority to issue directives.

In actual fact, the bankmoney regime is not 'neutral' and shows a number of recurrent and severe problems. In a sense one might say the bankmoney regime works 'too well' in that it recurrently provides the fuel that reproduces that bipolar syndrome of boom and bust, manias and crashes, of over-investment and over--indebtedness resulting in crises, in recent decades more in financial cycles than business cycles. The dysfunctions of the bankmoney regime cannot be discussed in detail within the limited scope of this paper, but shall at least be touched upon so as to gain an understanding of the matter beyond the merely technical functioning of the present money system.

The key problem is the out-of-control creation of bankmoney. With the general adoption of cashless payment practices, central banks have lost control over money creation, and since about 1980 they have entirely given up some such ambition – as if the stock of money was not relevant anymore, and as if short-term central bank interest rates could significantly influence a complex result of the economic process as is the inflation rate.

In addition, money and capital markets permanently fail to reach what might be a self-limiting equilibrium. In any market, there is a demand curve and a supply curve working in opposite directions. This applies in money and capital markets too, but at the same time there is a positive feedback loop superimposing itself on the negative one: on balance, rising asset prices and asset volumes attract additional demand rather than deterring it.[20] This results in recurrent market failure in the form of overshooting money supply, over-investment and over-indebtedness, asset inflation, bubbles and crises.

To a degree, this applies to real business cycles, too. Even if overheating business cycles and inflation have now faded into the background since the take-off of the Great Financial Immoderation around 1980, inflation actually represents between a half and two thirds of the now modest growth of nominal GDP.

An often-quoted IMF study has identified 425 systemic financial crises from 1970 to 2007 in migratory hot spots around the world, intensifying in number and severity. Of these, 145 were sector-wide banking crises, 208 currency crises and 72 sovereign debt crises.[21] The bankmoney regime is not the only cause of such crises, but the monetary system conditions finance, as finance determines the economy.

Many economists belittle the relevance of the monetary system, while at the same time putting hopes in present-day monetary policies for stabilising and stimulating finance and the economy – apparently not being aware of the contradiction between the belittlement and the hopes. In contrast to preceding stages in the development of modern economies, the fundamental role of the monetary system is nowadays largely neglected. In view of the increased weight of banking and financialisation this is paradoxical.

Banks have a strong incentive to expand their balance sheets—that is, creating as much primary credit and bankmoney, also for proprietary purposes, as they dare to risk and can fractionally refinance. This is strongly facilitated by the banks lead in creating the money on which they operate. In consequence, and on balance of the ups and downs, there is over-expansion of the banking sector's balance sheet and overshooting primary bankmoney creation, also feeding overshooting of secondary financial intermediation.[22]

In any crisis of a bank, the more so in a systemic banking crisis, it becomes apparent that bankmoney is unsafe. Bankmoney is but a promissory credit entry on a bank's balance sheet, not the 'real thing' that would be the property of the customers. If banks fail, the positions in their balance sheet are largely nullified, making the bankmoney disappear and bringing money circulation and the entire economy to a corresponding standstill. Interbank deposit insurance (just a little fig leaf) and government warranty (never tested) are simply proof of the non-safety of bankmoney.

Furthermore, a continued increase in financial assets in disproportion to GDP results in a biased income distribution.[23] The reason is that a growing share of current income and additional debt has to be devoted to servicing the claims of financial assets, disproportionately adding to financial income, which reduces the relative share of earned income.

Finally, and less reflected in present-day economics than was the case one to two centuries ago, money is a creature of the legal system.[24] Control of the currency and money creation, and benefitting from the seigniorage thereof are sovereign prerogatives¾in fact, of constitutional importance, and of the same rank as the prerogatives of legislation, public administration, jurisdiction, taxation and the use of force. Without these legal prerogatives, or monopolies respectively, a modern nation-state lacks sovereignty and functional capability, including, where applicable, the power to maintain the liberal rule of law.

Against this background, the present bankmoney privilege of the banking industry represents the illegitimate seizure of the sovereign prerogatives of money creation and seigniorage, rationalised by Banking School doctrine for 200 years, including untenable postulations such as the private-compact and market theory of money, and the false identity of money and bank credit.

The bankmoney regime pushes over-investment and over-indebtedness more pervasively than previous monetary regimes. But the banks and the financial industry cannot outsmart the gravitational force of productivity and economic output. Put differently, they cannot artificially extend the financial carrying capacity of the economy.

In ecology, carrying capacity means an ecosystem's capacity to provide and reproduce resources and sinks for a specified population. By analogy, an economy can carry only a limited volume of claims on income or economic output at any point in time. Financial carrying capacity relates to the sustainable levels of assets and debt as a ratio of GDP and additional non-Ponzi debt, notwithstanding the potential for extending such limits by sustainable productivity gains on the basis of innovation and structural change. If the carrying capacity of an ecosystem is overburdened, it breaks down or dies off; if the financial carrying capacity of an economy is overburdened, it crashes or declines. Violation of systemic tolerances will always result in crises.

The perspective: a single-circuit sovereign money system

If the bankmoney-led split-circuit reserve system is at the root of the problems discussed above, the solution is a single-circuit sovereign money system.[25] Sovereign money is legal tender, in most cases issued by the central bank of a state or community of states. Today, coins and central-bank notes are sovereign money as well as central-bank reserves, not, however, bankmoney.[26] In a sovereign money system, the customers' money-on-account will be sovereign central-bank money too, circulating among the public and the banks alike. This is a move beyond reserve banking, where reserves (central bank money-on-account) are reserved for the banks and withheld from the public. A single-circuit system thus is not another variety of 100% reserve banking in a split-circuit system.

From a technical point of view, the transition from split-circuit bankmoney to single-circuit sovereign money can easily be achieved by converting demand deposits into central bank money and taking the respective accounts off the banks' balance sheet, enabling the direct money transfer between customers, without monetary intermediation by the banks. This then results in the separation of money and payment services from the banks' lending and investment business – which is a key feature of chartalist Currency School teaching.

Alternatively, a more gradual transition process could be triggered by introducing a new type of account for customers, that is, sovereign-money accounts, in addition to the existing bank giro accounts, but safe and separate from these. The new accounts can be managed in trust by banks and other providers of payment services, similar to securities accounts off a provider's balance sheet. The entries in such accounts would represent central bank money and be the possession of the customers. A similar result might soon be achievable by introducing central bank digital currency on the basis of blockchain technology, serving as a modern equivalent to traditional solid cash.[27]

A number of modellings – based on different approaches such as DSGE, system dynamics and stock-flow-analysis – came up with basically convergent findings. Sovereign money would not only be safe, but also bring about significantly more financial and economic stability, non-volatile normal interest rates, low inflation, non-GDP-disproportionate growth in financial assets and debt, and a higher level of output and employment.[28]

Sovereign money is about re-nationalising money creation and seigniorage—not, however, nationalising banking and the uses of money. Thus, money creation and control of the stock of money would be made the sole responsibility of the central banks, provided these are independent national monetary authorities, or the authority of a community of nation-states (such as the ECB); preferably no longer joint-stock companies, or at least with a government share of over 50% and full government investiture of the top personnel, similar to the appointment of judges.

Like the judiciary, central banks need to be independent and impartial, in fact representing a fourth branch of the state. A sound sovereign money system includes a thorough separation of monetary and fiscal state powers, and of both from banking and wider financial market functions.

The central banks in such a system would pursue discretionary and flexibly capacity-oriented monetary policies on the basis of a redefined legal mandate. The latter would include restated policy objectives and indicators such as comprehensive factor employment, interest rates, foreign exchange rates, inflation, asset inflation, asset and debt bubbles and financial assets-to-GDP ratios.

This does not mean overloading central banks and expecting too much from monetary policy. With sovereign money, too, the money system is a most important foundation of finance and the economy, not however a magic force that could attain desired goals by itself. But monetary policy can of course contribute much for the better or the worse. In a single-circuit sovereign money system central banks would have full control of the stock of money. Their policies, unlike today, would thus be directly and fully effective.

Literature

Andolfatto, David 2015. Fedcoin – on the desirability of a government cryptocurrency, Macromania, 3 Feb 2015, http://andolfatto.blogspot.de/2015/02/fedcoin-on-desirability-of-government.html.

Atkinson, Anthony B. / Piketty, Thomas / Saez, Emmanual 2011. Top Incomes in the Long Run of History, Journal of Economic Literature, 2011, 49:1, 3–71.

Atkinson, Anthony B. 2015. Inequality. What can be done? Cambridge, MA: Harvard University Press.

Baba, Naohiko / McCauley, Robert N. / Ramaswamy, Srichander 2009. US dollar money market funds and non-US banks, BIS Quarterly Review, March 2009, 65–81.

Barrdear, John / Kumhof, Michael 2016. The macroeconomics of central bank issued digital currencies, Bank of England, Staff Research Paper No. 605, July 2016.

Benes, Jaromir / Kumhof, Michael 2012: The Chicago Plan Revisited, IMF Working Paper WP/12/202. A revised draft dates from February 12, 2013.

Bindseil, Ulrich 2004. The Operational Target of Monetary Policy and the Rise and Fall of Reserve Position Doctrine, ECB Working Paper Series, No. 372, June 2004.

BIS (Bank for International Settlements) 2015. Digital currencies, prep. by the BIS Committee on Payments and Market Infrastructures, Basel, www.bis.org/cpmi/publ/d137.pdf.

Bjerg, Ole 2014: Making Money. The Philosophy of Crisis Capitalism, London: Verso Books.

Broadbent, Ben 2016. Central banks and digital currencies, http://www.bankofengland.co. uk/publications/Pages/speeches/2016/886.aspx.

Constâncio, Vítor 2011. Challenges to monetary policy in 2012. Speech at the 26th International Conference on Interest Rates, Frankfurt: European Central Bank.

Dow, Sheila / Johnsen, Guðrún / Montagnoli, Alberto 2015. A critique of full reserve banking, Sheffield Economic Research Paper Series, no. 2015008, March 2015.

Dyson, Ben / Hodgson, Graham / van Lerven, Frank 2016. A response to Critiques of 'Full Reserve Banking' or 'Sovereign Money' Proposals, Cambridge Journal of Economics, Vol. 40 (5) Sep 2016, 1351–1361.

Dyson, Ben 2013. Dirk Bezemer on Positive Money, positivemoney.org/2013/04/dirk-bezemer-on-positive-money-a-response.

Fontana, Giuseppe / Sawyer, Malcolm 2016. More Cranks than Brave Heretics, Cambridge Journal of Economics, Vol. 40 (5) Sep 2016, 1333–1350.

Gray, Simon 2011. Central Bank Balances and Reserve Requirements, IMF Working Paper WP/11/36, 55.

Hilton, Adrian 2004. Sterling money market funds, Bank of England, Quarterly Bulletin, Summer 2004, 176–182.

Huber, Joseph / Robertson, James 2000. Creating New Money, London: New Economics Foundation.

Huber, Joseph. 1998. Vollgeld, Berlin: Duncker & Humblot.

Huber, Joseph. 2015. Monetary Puzzlement. Why central banks perform worse than they could, www.sovereignmoney.eu/monetary-puzzlement.

Huber, Joseph.2016. Monetary Stopgaps. Intermediate approaches to monetary reform: digital cash and sovereign money accounts for everyone, first version spring 2015, www.sovereignmoney.eu/monetary stopgaps.

Huber, Joseph 2017. Sovereign Money. Beyond Reserve Banking, London/New York: Palgrave.

Hudson, Michael. 2006. Saving, Asset-Price Inflation, and Debt-Induced Deflation, in Wray, L. Randall / Forstater, Matthew (eds.). 2006. Money, Financial Instability and Stabilization Policy, Cheltenham: Edward Elgar, 104–124.

Huerta de Soto, Jesús 2009. Money, Bank Credit, and Economic Cycles, Auburn, Al.: Ludwig von Mises Institute, 2nd edition.

Jackson, Andrew / Dyson, Ben 2012. Modernising Money. Why our monetary system is broken and how it can be fixed, London: Positive Money.

Jordà, Òscar / Schularick, Moritz / Taylor, Alan M. 2010. Financial Crises, Credit Booms, and External Imbalances. 140 Years of Lessons, NBER Working Papers, No. 16567, Dec 2010.

Keene, Steve 2011. Debunking Economics, London/New York: Zed Books.

Knapp, Georg Friedrich 1905: Staatliche Theorie des Geldes, Leipzig: Duncker & Humblot. - Engl. 1924: The State Theory of Money, London: Macmillan & Co., republ. 1973, New York: Augustus Kelley.

Kumhof, Michael / Jacab, Zoltan, 2015. Banks are not intermediaries of loanable funds — and why this matters, Bank of England Working Paper, No. 529, May 2015.

Kydland, Finn E. / Prescott, Edward C., 1990. Business Cycles: Real Facts and a Monetary Myth, Federal Reserve of Minneapolis Quarterly Review, Spring 1990, 3–18.

Laeven, Luc / Valencia, Fabian 2008. Systemic Banking Crises. A New Database, IMF Working Paper WP 08/224.

Lagos, Ricardo 2006. Inside and Outside Money, Federal Reserve Bank of Minneapolis, Research Department Staff Report, No. 374, May 2006.

Lainà, Patrizio. 2015. Money Creation under Full-Reserve Banking: A Stock-Flow Consistent Model, Levy Economics Institute Working Papers, No. 851, Oct 2015.

Lerner, Abba P. 1943: Functional Finance and the Federal Debt, in: Colander, David C. (ed.), Selected Economic Writings of Abba P. Lerner, New York University Press 1983, 297–310. First publ. in Social Research, Vol.10 (1943) 38–51. Available at: http://k.web. umkc.edu/kelton/Papers/501/functional% 20finance.pdf.

Lerner, Abba P. 1947: Money as a Creature of the State, American Economic Review, Vol.37, May 1947, No.2, 312–317.

McLeay, Michael / Radia, Amar / Thomas, Ryland 2014. Money creation in the modern economy, Bank of England Quarterly Bulletin, 2014 Q1, 14–27.

McMillan, Jonathan 2014. The End of Banking. Money, Credit, and the Digital Revolution, Zurich: Zero/One Economics.

Minsky, Hyman P. 1982. The Financial Instability Hypothesis, in: Kindleberger, C.P./ Laffargue, J.-P. (Eds.). Financial Crises. Theory, History, and Policy, Cambridge University Press, 13–39.

Minsky, Hyman P. 1986. Stabilizing an Unstable Economy, New Haven: Yale University Press.

Moore, Basil J. 1988a. Horizontalists and Verticalists: The Macroeconomics of Credit Money, Cambridge University Press.

Moore, Basil J. 1988b. The Endogenous Money Supply, Journal of Post Keynesian Economics, vol.10, no.3, 1988, 372–385.

Palley, Thomas I. 2013. Horizontalists, Verticalists, and Structuralists: The Theory of Endogenous Money Reassessed, Review of Keynesian Economics, Vol. 1(4) 2013, 406–424.

Pettifor, Ann. 2014. Why I disagree with Positive Money and Martin Wolf, Open Democracy UK, 30 April 2014, www.opendemocracy.net/ourkingdom/ann-pettifor/why-i-disagree-with-positive-money-and-martin-wolf.

Piketty, Thomas 2013: Le capital au XXI siècle, Paris: Éditions du Seuil. Engl. 2014: Capital in the Twenty-First Century, Cambridge, MA: The Presid. Fellows of Harvard College.

Positive Money 2014: Creating a Sovereign Monetary System, London: Positive Money. www.positivemoney.org/our-proposals/creating-sovereign-monetary-system.

Roche, Cullen 2012. Understanding Inside Money and Outside Money, Pragmatic Capitalism, www.pragcap.com/understanding-inside-money-and-outside-money.

Rochon, Louis-Philippe 1999a. Credit, Money and Production. An Alternative Post-Keynesian Approach, Cheltenham: Edward Elgar.

Rochon, Louis-Philippe 1999b. The Creation and Circulation of Endogenous Money, Journal of Economic Issues, vol.33, 1999, no.1, 1–21.

Rossi, Sergio 2007. Money and Payments in Theory and Practice, London/New York: Routledge.

Ryan-Collins, Josh / Greenham, Tony / Werner, Richard / Jackson, Andrew 2012. Where Does Money Come From? A guide to the UK monetary and banking system, 2nd edition, London: New Economics Foundation.

Schemmann, Michael 2012. Accounting Perversion in Bank Financial Statements. The Root Cause of Financial Crises, IICPA Publications.

Schemmann, Michael 2012b: Liquid Money – the Final Thing. Federal Reserve and Central Bank Accounts for Everyone, IICPA Publications.

Schemmann, Michael 2013: Money Breakdown and Breakthrough. The History and Remedy ofFinancial Crises and Bank Failures, IICPA Publications.

Schularick, Moritz / Taylor, Alan M. 2009. Credit Booms Gone Bust: Monetary Policy, Leverage Cycles, and Financial Crises 1780–2008, American Economic Review, 102 (2) 1029–1061.

Shiller, Robert J. 2015. Irrational Exuberance, revised and expanded 3rd edition, Princeton NJ: Princeton University Press.

Sigurjonsson, Frosti 2015: Monetary Reform. A better monetary system for Iceland, Icelandic Parliament, submitted to the Committee on Economic Affairs and Trade, March 2015. http://eng.forsaetisraduneyti.is/media/Skyrslur/ monetary-reform.pdf.

Steinmetz, Greg 2016. The Richest Man Who Ever Lived. The Life and Times of Jacob Fugger, New York: Simon & Schuster.

van Egmont, Klaas / de Vries, Bert. 2015. Dynamics of a sustainable financial-economic system, Sustainable Finance Lab Utrecht University, Working Paper, March 2015.

Walsh, Steven / Zarlenga, Stephen 2012. Evaluation of Modern Money Theory, American Monetary Institute Research Paper, www.monetary.org/mmtevaluation.

Werner, Richard A. 2005. New Paradigm in Macroeconomics, London/New York: Palgrave.

Werner, Richard A. 2014. Can banks individually create money out of nothing? Theories and empirical evidence, International Review of Financial Analysis 36 (2014) 1–19.

Werner, Richard A. 2015. A lost century in economics - three theories of banking and the conclusive evidence, International Review of Financial Analysis, Vol. 46, July 2016, 361–379.

Wray, L. Randall (ed.) 2004. Credit and State Theories of Money. The Contributions of A. Mitchell-Innes, Cheltenham: Edward Elgar Publishing.

Wray, L. Randall 1998. Understanding Modern Money, Cheltenham, UK: Edward Elgar.

Yamaguchi, Kaoru 2012: On Monetary and Financial Stability under A Public Money System. Modeling the American Monetary Act Simplified. In: Proceedings of the 30th International Conference of the System Dynamics Society, St. Gallen, 2012.

Yamaguchi, Kaoru 2014: Money and Macroeconomic Dynamics. An Accounting System Dynamics Approach, Awaji Island: Muratopia Institute/Japan Futures Research Center. www.muratopia.org/Yamaguchi/MacroBook.html.

Yamaguchi, Kaoru / Yamaguchi, Yokei. 2016. Peer-to-Peer Public Money System, Japan Futures Research Center, Working Paper No. 02-2016, Nov 2016.

Zarlenga, Stephen A. 2002. The Lost Science of Money. The Mythology of Money – the Story of Power, Valatie, NY: American Monetary Institute.

Zarlenga, Stephen A. 2014. The Need for Monetary Reform. Presenting the American Monetary NEED Act, Valatie, N.Y.: American Monetary Institute.

Endnotes

[1] Cf. Financial Accounting Standards Board: FASB Accounting Standards Codification, Topic 305-2011, Cash and Cash Equivalents. The same in US GAAP (Generally Accepted Accounting Principles). For a critical assessment see Schemmann 2012, also Bill Bergman at www. truthinaccounting.org/news/type/bills-blog.

[2] Important contributions to the bank credit theory were made by Macleod, Withers, Hawtrey and Hahn, also by Schumpeter as well as von Mises.

[3] For example, the so-called creditary economics of D. Bezemer and colleagues, which may have its merits in other respects (see Dyson 2013), or R. Wray 1998 and other MMTers, referring to Mitchell-Innes' wound-up Credit Theory of Money from 1913/14 (Wray (ed.) 2004 14–78).

[4] For example, Pettifor 2014, Dow/Johnsen/Montagnoli 2015; Dyson /Hodgson/van Lerven 2016 responding to Fontana/Sawyer 2016.

[5] Moore 1988 162–63, 1988b. The horizontal or accommodationist approach of post-Keynesianism became revised as the structuralist approach (Palley 2013). The position contrasts with the verticalist view, which has it that central bank credit comes first. Also cf. Rochon 1999 155–201, 1999b, Keen 2011 pp.309, Constâncio 2011. Kydland/Prescott, too, 1990 have shown that the initiative is with the banks, not the central bank, and that the multiplier model thus is a myth.

[6] Cf. Moore 1988a, 1988b. Rochon 1999b, 1999a 15, 17, 155, 163, pp.166. Rossi 2007 pp.29, Keen 2011 pp.358. The notion of endogeneity of money goes back to Wicksell.

[7] Lagos 2006, Roche 2012.

[8] Examples of computerised payment systems include Fedwire = Federal Reserve Wire Network (USA, RTGS); CHIPS = Clearing House Interbank Payment System (USA, combines continual real-time clearing with daily final settlement in reserves); CHAPS = Clearing House Automated Payment System (UK, RTGS); TARGET2 = Trans-European Automated Real-Time Gross Settlement Express Transfer System (Euro/EZB); BoJ-Net = Bank of Japan Funds Transfer Network System; CLS = Continuous Linked Settlement System, for international payments (combines, like CHIPS, clearing and final settlement).

[9] Cf. Huber 2017 71–72. Ryan-Collins/Greenham/Werner/Jackson 2012 75.

[10] Gray 2011.

[11] Huerta de Soto 2009 chs. 1–3.

[12] Steinmetz 2016 chs. 4, 6–7.

[13] Also cf. Kumhof/Jacab 2015, McLeay/Radia/Thomas 2014, Werner 2014, 2015. Werner, though, fully right as he is with regard to his refutation of the loanable funds and financial intermediation models, is misleadingly incomplete with regard to reserve circulation and credit creation 'out of nothing'. A reservation regarding McLeay/Radia/Thomas relates to their still maintained belief in transmission of central bank policies to the banks and the entire economy by setting base rates.

[14] McMillan 2014 54–79, Baba/McCauley/Ramaswamy 2009 68, Hilton 2004 180.

[15] The approach to subdividing equations of circulation into a real-economic and financial hemisphere, the latter consisting of GDP-contributing and non-contributing financial transactions, has been put forth by Huber (1998 224) and Werner (2005 185). In a similar attempt, Hudson 2006 has introduced the FIRE sector (Finance, Insurance, Real Estate) into his macroeconomic model.

[16] The proverb reads 'garbage in, garbage out', referring to both the variables and their interconnections in a model and the data attributed to the variables.

[17] For a criticism of the multiplier model also see Werner 2005 pp.191, Keen 2011 306–312, Ryan-Collins/Greenham/Werner/Jackson 2012 16–25, Jackson/Dyson 2012 75–80.

[18] Bindseil 2004.

[19] Cf. Huber 2015 16–17, 2016.

[20] Also cf. Shiller 2014 pp.225.

[21] Laeven/Valencia 2008.

[22] For the criteria and empirical data of overshooting bankmoney supply see Huber 2017, 109–112. For related credit and debt bubbles see Shiller 2015 70–97, Minsky 1982, 1986 pp.206, pp. 218, pp.223, pp.294, Jordá/Schularick/ Taylor 2010, Schularick/ Taylor 2009.

[23] Inequality of income and wealth increasing again since about 1980 has been identified by many studies of late, among these Atkinson/Piketty/Saez 2011, Atkinson 2015, Piketty 2013.

[24] Money and the monetary system as a public legal matter cause was a key feature in the British Currency School of the 1820–40s, the state theory of money around 1900 (Knapp 1905/1924) and Keynesianism since the 1940–50s (Lerner 1943, 1947). The teaching dates back via medieval Thomism to Aristotle: 'Money exists not by nature but by law' (Ethics 1133 a 30).

[25] There is a growing number of publications with similar analyses and the same conclusions, for example, Huber/Robertson 2000, Zarlenga 2002, 2014, Keen 2011, Schemmann 2012b, 2013, Jackson/Dyson 2013, Bjerg 2014, Positive Money 2014, Yamaguchi 2014, Sigurjonsson 2015. There is also a substantial body of non-English literature on the subject.

[26] The situation is more difficult in countries where the central bank is not a government body or an inter-governmental body as is the case with the ECB, but still a private commercial institution (e.g. South Africa) or a private-public hybrid as is the case with the Federal Reserve in the US.

[27] Recent contributions to separate sovereign money accounts and central bank digital currencies include Andolfatto 2015, BIS 2015, 2015, Huber 2016, Dyson/Hodgson 2016, Broadbent 2016, Barrdear/Kumhof 2016, Yamaguchi/Yamaguchi 2016.

[28] Yamaguchi 2012, Kumhof 2012/13, Lainà 2015, van Egmont/de Vries 2015.

This article has been published in the real-world economics review RWER, issue no. 80, 26 June 2017, 63-84, under the heading > Split-circuit reserve banking. Download from RWER

Contents

Introduction

Main elements of reserve banking today

- The split-circuit structure of reserve

banking

- Modern money is non-cash

- Credit extension and money creation in

one act

- The money system is bank-led

- Is bankmoney 'endogenous', and are

central banks 'outside' the markets?

- Credit creation and balance sheet

extension by cooperative bankmoney

creation

- Bankmoney transfer via reserve transfer

- Deletion of bankmoney and reserves

- De- and re-activation of bankmoney

- Fractional reserve banking and its

operating conditions

A bankmoney regime backed by the central banks and warranted by governments

- The piggy bank model

- The loanable funds model of deposits

- The financial intermediation theory of

banking

- The credit multiplier, the reserve position

doctrine and other fictitious elements of

monetary policy

Lost control. Dysfunctions of the bankmoney regime

The perspective: a single-circuit sovereign money system

Download this article from the real-world economics review as a PDF >